The goal was to create a modern, elegant, and user-friendly website that would not only attract potential clients but also provide a seamless online experience, showcasing the studio and allowing customers to book appointments and explore services.

I’m passionate about empowering creators with no-code web design tools. My mission is to bring your digital visions to life quickly and effectively.

"If A Man Knows Not To Which Port He Sails No Wind Is Favorable."

-Seneca

Introduction

I want to use regatta as an example for my introduction to present the title and theme of this article duly. Boats need favorable wind to move forward at a faster pace. The best team to make the best use of it wins the race against all. This comes with difficulties, as wind is – sometimes, or to a certain extent – unpredictable, hence it has external factors that greatly influence the outcome. The participants in this metaphorical context are the companies/sectors and above them the countries/politics. They must use the “wind” to their best ability to gain an advantage in the 'global race'. Even though certain elements are not under their influence, they must adequately adapt to a fast-changing environment and “win”. (Winning in this context is exaggerated as there is no end-point, only cycles, terms, etc., on country or company level) This article draws on insights from reliable sources (see sources section at the end of the article) to provide an overview of the economic and market outlook for the coming year(s).

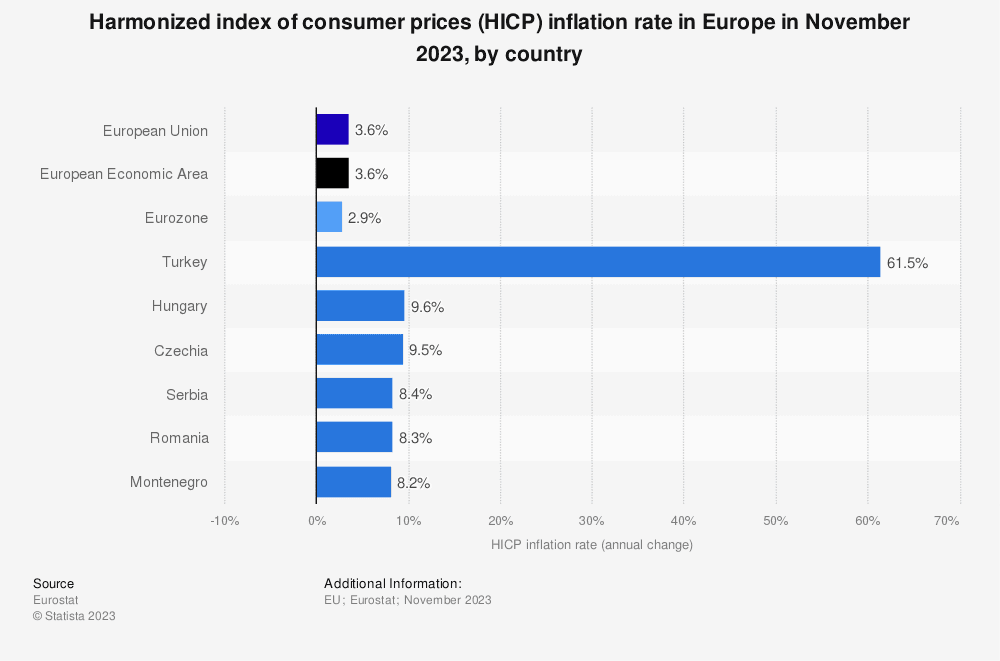

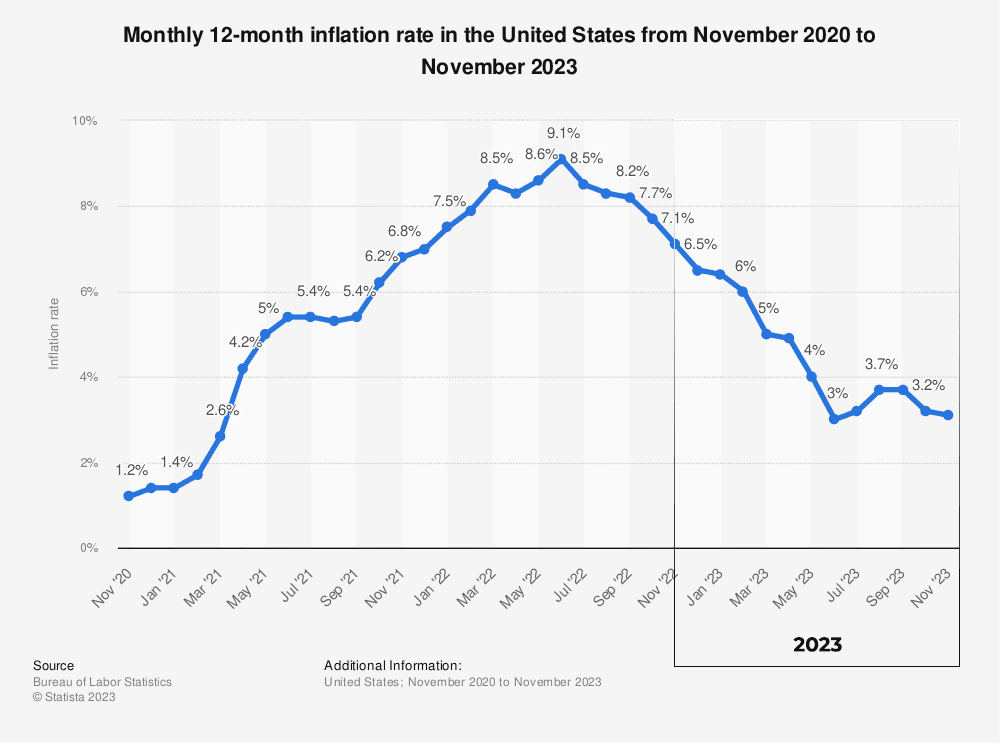

Global markets have gone through changes since COVID hit and then the war in Ukraine, which slowly consumes a larger portion of reserves of the US and EU in the forms of state aid and support to Ukraine, not to mention the sanctions that also have economic growth slowing effect pairing with high inflation, which was high and still is for certain countries such as Turkey, Hungary, Czechia, Serbia, Romania, etc. standing above 8%, and is at 3.2% in the US as of November 2023. (Though in the EU it is slowly decreasing due to the adjustable markets, supply, gaining economic momentum, etc.)

I emphasize the US as it still shows itself as the largest economy of them all, laying influence on 'each' country, since they are to some sort influenced by - Not the mention the globalization ambitions of the US, which extends from West to East including one of the main players too such as China -.

I selected Vanguard and BlackRock to have a proper insight on the current economy of the US, as they are the largest fund management, and their studies - and efficiency too - proved to be trustworthy sources. The total assets under their management are worth approximately $16+ trillion.

II. Vanguard's Perspective in the US

- Interest rates and Inflation: Vanguard predicts that interest rates may moderate after recent peaks, but are likely to grow in the upcoming years, which the market has to adjust to. The reasoning behind this is due in part to the central bank’s efforts to lower inflation. Based on the report, the US and other developed markets will grapple with mild recessions in coming quarters, hence cutting interest rates, that will remain above the rate of inflation in the US. This is likely to persist in the long term.

- Return to Sound Money: as Vanguard has defined ‘the persistence of positive real interest rates’ provides a solid foundation for long-term risk-adjusted returns for investors, strengthening the case for the traditional 60/40 portfolio (60% stocks, 40% bonds) for long-term investors, which outlines the next part – investment strategies and asset valuations. The rise of interest rates is rather opportunistic for investors. (US bonds are expected to return 4.8%-5.8% annually over the next decade, while international bonds are anticipated to yield 4.7-5.7% annually over the same period. This could offset the capital losses experienced in recent years (s), which is raising the value of portfolios in the long term. The shift to higher interest rates - or to sound money - will have significant implications for the global economy and financial markets, affecting borrowing, saving behavior, capital allocation, and asset class return expectations.

- Investment Strategies and Asset Valuation: As US equities continue to outperform international ‘rivals’ in valuation expansion and US dollar strength, they may seem to lose their ‘key role’ in the upcoming years – suggested Vanguard – which forms opportunities outside the US in the future, providing more balanced return outcome for diversified investors. It is also important to note that higher interest rates have led to overvalued equities and depressed asset price valuations globally, which will - likely - moderate too.

J.P. Morgan's Outlook

J.P. Morgan's research states that after the S&P 500's decline in 2022 and recovery in 2023 (due to the growth of Nvidia, Amazon, etc.), corporate margins may face challenges in 2024, mainly because of the high inflation at the end of the period. J.P. Morgan expects to have a mode of earnings growth for the S&P 500 in 2024, as they are more cautious and seem to be reserved for the next year, due to high inflation, geopolitical risks, upcoming elections, and expensive asset valuations. Regarding the commodity market outlook, Brent oil prices will remain stable in the upcoming year, while metals, mainly gold and silver will experience a rise in 2024 and 2025. The outlook for major currencies varies on region, the dollar is likely to remain on its current level, while the euro and British pound may face difficulties.

Vanguard’s Global Economic Outlook

The market proved to be more resilient in 2023 than expected before, which may have been due to the less restrictive monetary policy. However, in 2024 monetary policy is expected to become more restrictive with the fall of inflation, which could lead to a mild economic downturn - to reach inflation targets, hence to ensure inflation continues to decrease. However, the Central banks are expected to start cutting policy rates in the second half of 2024 as they gain confidence in inflation moving towards the desired path. - Based on Morgan Stanley's Global Macroeconomic Outlook for 2024, emerging markets may experience a slower reduction in inflation due to the volatility in food and also energy prices, which has influenced inflation in a lot of countries. A mixed growth is predicted for countries like Indie, Indonesia, Philippines, while China may have slower growth - The higher interest rates will affect households and businesses, resulting in savings. This environment is also beneficial for investors as higher interest rates will help achieve long-term financial goals, but it comes with market volatility. The report also highlights the US’s ability in terms of economic resilience to – likely – fade in 2024, as inflation falls and monetary policy becomes more restrictive. EU’s economy is already near recession but is expected to have minor growth, but they are still battling with high energy prices and energy supply shocks, their recovery is expected in 2025 with the decline of inflation and a resilient job market. Central Europe, the Middle East, and Africa may have varying growth rates across the regions, Poland should start to recover, and the growth will pick up in Hungary and the Czech Republic, while Turkey will see a slowdown. Due to the conflict in Gaza, Israel will see a steady recovery in the first three months of 2024. China’s economic rebound has been weaker after COVID-19 but is expected to continue its recovery amid increasing challenges and pressure laid on them mainly by the US.

BlackRock’s practical approach

This part is solely based on their reports and is more practical in some sort. In their view, the greater volatility and structural interest rates are unpredictable currents, which require active portfolio management. They think that higher interest rates and greater volatility define the new ‘era’, which not only companies, and countries, but investors have to adapt to with its ‘unique’ opportunities. The central banks need to face ‘tougher trade-offs’ in fighting inflation, while they are not so resilient against it due to slower growth as they used to be. This creates uncertainty for central banks, and investors too. After COVID the shrinking workforces, geopolitical fragmentation, and the low-carbon transition are also taking their toll on market effectiveness. The tougher environment forms the ground for higher interest rates and tougher financial conditions too, hence comes the importance of the adaptability of the markets to the ‘new regime’. BlackRock adds – which I agree with – that due to the higher volatility of markets, being dynamic with investment strategies is going to be essential – which will raise the importance of fund management companies along with thorough research and constant monitoring of macro environments, because opportunities can arise from market fluctuations.

In their Outlook BlackRock also refers to ‘mega forces – suggesting a focus on large-scale, structural changes’, that will also have a significant impact on the global economy and financial markets. These mega forces can include a range of factors such as technological advancements (such as AI – which they dedicate complete sections to), demographic shifts, climate change, geopolitical developments, and changes in global trade patterns. These large-scale shifts can be leveraged as opportunities, much like a sailor uses favorable winds to move forward to their destination.

I would also like to highlight some ‘examples’ too to each of them as follows:

1. Technological Advancements: Investing in companies or sectors that are at the forefront of technological innovation or somehow benefiting from it.

2. Demographic Shifts: Taking into account the aging populations in certain regions which can affect consumer markets, healthcare needs, and labor supply too.

3. Climate Change: Investing in renewable energy, sustainability, or companies that are adapting to it or mitigating the impacts of climate change.

4. Geopolitical Developments: As we are at the forefront of a ‘new era’ with uncertainties and constant market changes with companies and countries adjusting to them, investors should adjust their portfolios likewise in response to changes in international relations, trade policies, and regulatory environments.

5. Global Trade Patterns: Finding new opportunities which are emerging markets or sectors that stand to benefit from shifts in global trade dynamics.

Conclusion: Sailing into a New Era

We are sailing on complex waters of the global economy, as the tides are big, we are still battling and the wind is light, while other external factors are weakening our chances of navigating out of foggy weather. I collected insights from reliable sources to present the current opinions and forecasts for 2024 and the upcoming years. To summarize everything written, a new era is coming, where waves collide and companies, sectors, and leaders must be willing to adapt to new environments. The faster you adjust by riding the biggest waves, the bigger the result will be. The aftermath of the COVID-19 pandemic and the Ukraine conflict presents challenges, while growth opportunities arise with innovation new strategies in investment, and active portfolio management to properly smooth the dynamics of markets, highlighting the importance of informed decision-making. As BlackRock suggests 'mega forces' are what we have to look out for such as technological advancements, demographic shifts, and climate change pairing with geopolitical conflicts and factors. By staying informed, flexible, and forward-thinking, we can harness the winds of change to sustain our growth, just as skilled sailors.

Sources:

https://www.blackrock.com/corporate/literature/whitepaper/bii-global-outlook-in-charts.pdf

https://www.morganstanley.com/ideas/global-macro-economy-outlook-2024

https://www.jpmorgan.com/insights/global-research/outlook/market-outlook